36+ 30 year mortgage calculator interest

Account for interest rates and break down payments in an easy to use amortization schedule. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

36 Acres Cottonwood Hills Subdivision Missouri Valley Ia 51555 22 876 Berkshire Hathaway Homeservices Ambassador Real Estate

However the longer your term the greater interest charges accrue.

. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Larger monthly payments might mean only qualifying for a lower loan amount. Use this free Washington Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

That means your mortgage payment should be a maximum of 1120 28 percent of 4000 and your other debts should add up to no more than 1440 each month 36 percent of 4000. In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage. Use our calculator above.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Monthly Principal Interest. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan.

With a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403. A 30-year mortgage comes with a locked interest rate for the entire life of the loan. The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global.

People typically move homes or refinance about every 5 to 7 years. But since it pays off your mortgage in half the time it incurs much lower interest charges. 30 Year Fixed Rate.

Mortgage loan basics Basic concepts and legal regulation. Year-to-date business profit and loss statement for current year if more than three months have passed since the end of the tax year. Mortgage interest rates are dependent on many factors.

Need a sample amortization schedule for a 30-year fixed mortgage. Gain home equity faster pay off your debt sooner. Helps you pay off your loan faster and reduce the total interest you will pay on your mortgage.

Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. In a 30-year fixed rate mortgage the interest payment that we make is probably very. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment.

If youve taken a 30-year FRM you can refinance to a 15-year term after a couple of years. Assuming a loan term of 30 years with an interest rate of 5 you may qualify for a home up to 74066 and have a monthly payment of 467. 15-year FRMs also have rates that are lower by 025 to 1 than 30-year FRMs.

However getting out from under a monthly mortgage payment 15 years earlier while building equity in your home faster could still be enticing especially for first-time. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. Putting It All Together.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Head on over to our mortgage qualifying calculator to determine what those amounts will be with different interest rates and loan terms. Calculate Fifty Year Home Loan Payments.

Assuming you have a 20 down payment 80000 your total mortgage on a 400000 home would be 320000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1437 monthly payment. A 15-year fixed mortgage sits at 538 a 296 rise. For interest rates as of June 2022 a 30-year fixed-rate mortgage sits at 618 a 315 rise from the previous year.

Mortgage interest rates are always changing and there are a lot of factors that. Meanwhile shorter terms such as 15-year FRM have higher monthly payments. A fully amortizing 30-year payment a fully amortizing 15-year payment an interest-only payment and a specified minimum payment.

It considers the size of your loan the downpayment amount and the length of the payment term. This allows you to secure a lower rate and pay your mortgage earlier. Mortgage Amount Interest Rate Mortgage Term years Total Interest.

These interest-only home loans are typically 30-year ARMs which enable the borrower to pick-a-payment between four amounts. The 52-week high for a 30-year fixed mortgage was 6. Todays average rate on a 30-year fixed mortgage is 607 compared to the 598 average rate a week earlier.

What do you do. At 6 fixed interest that amount rises to 1986. But if you earned significantly more in one year than the other the lender may opt for the years.

As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR. Current 30-Year Mortgage Rates. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan.

Mortgage Prepayment Calculator to calculate early payoff for your mortgage payments based on a desired monthly payment or the number of years until payoff. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Save more on total interest cost compared to a 30-year term.

Build home equity much faster. If a person. Because the rate stays the same expect your monthly payments to be fixed for 30 years.

Less money for savings. Interest Rate APR 3995. Yes its possible to get a mortgage on 20k a year.

A mortgage of 300000 will cost you 1620 per month in interest and principal for a 30-year loan and a fixed 4 interest rate. Down payments as low as 3 of purchase price. Use our free mortgage calculator to estimate your monthly mortgage payments.

Loan terms between 10 and 30 years. Use this free Georgia Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Simple Mortgage Calculator. Lower interest rate shorter terms can be 025 to 1 lower than 30-year fixed-rate loans. Mortgage Type 50-YR FRM 30-YR FRM.

Limits your purchasing power.

36 Acres Cottonwood Hills Subdivision Missouri Valley Ia 51555 22 876 Berkshire Hathaway Homeservices Ambassador Real Estate

36 Signal Hill Road Wilton Ct 06897 Compass

Abraxasdecember2016catal

Northport Maine Real Estate Re Max Jaret Cohn

1218 36th Ave N Saint Cloud Mn 56303 Realtor Com

Mortgage Rates Have Never Been Lower

Abraxasdecember2016catal

Abraxasdecember2016catal

Tbd N Martin Road Mount Hermon La 70450 4 Photos Mls 2359257 Movoto

Free 36 Accountant Resume Samples In Ms Word Pages

Zerarwwmasbtjm

Trading Card Retro Style Baseball Card Template Trading Card Template Cards

4 Hotchkiss Grove Rd Branford Ct 06405 Realtor Com

Generating Lasting Wealth Springerlink

Pin On Garden

423xx W Saddle Vista Road 24 Tonopah Az 85354 Mls 6302348

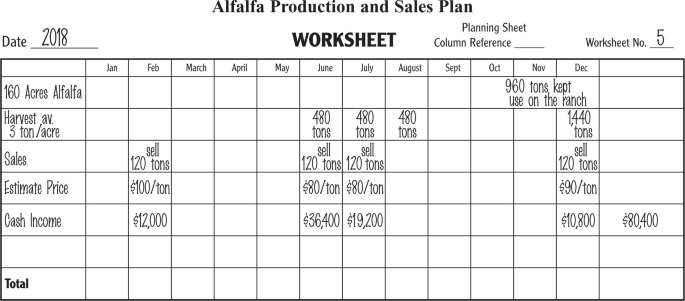

Expense Report 36 Examples Samples Pdf Google Docs Pages Doc Examples